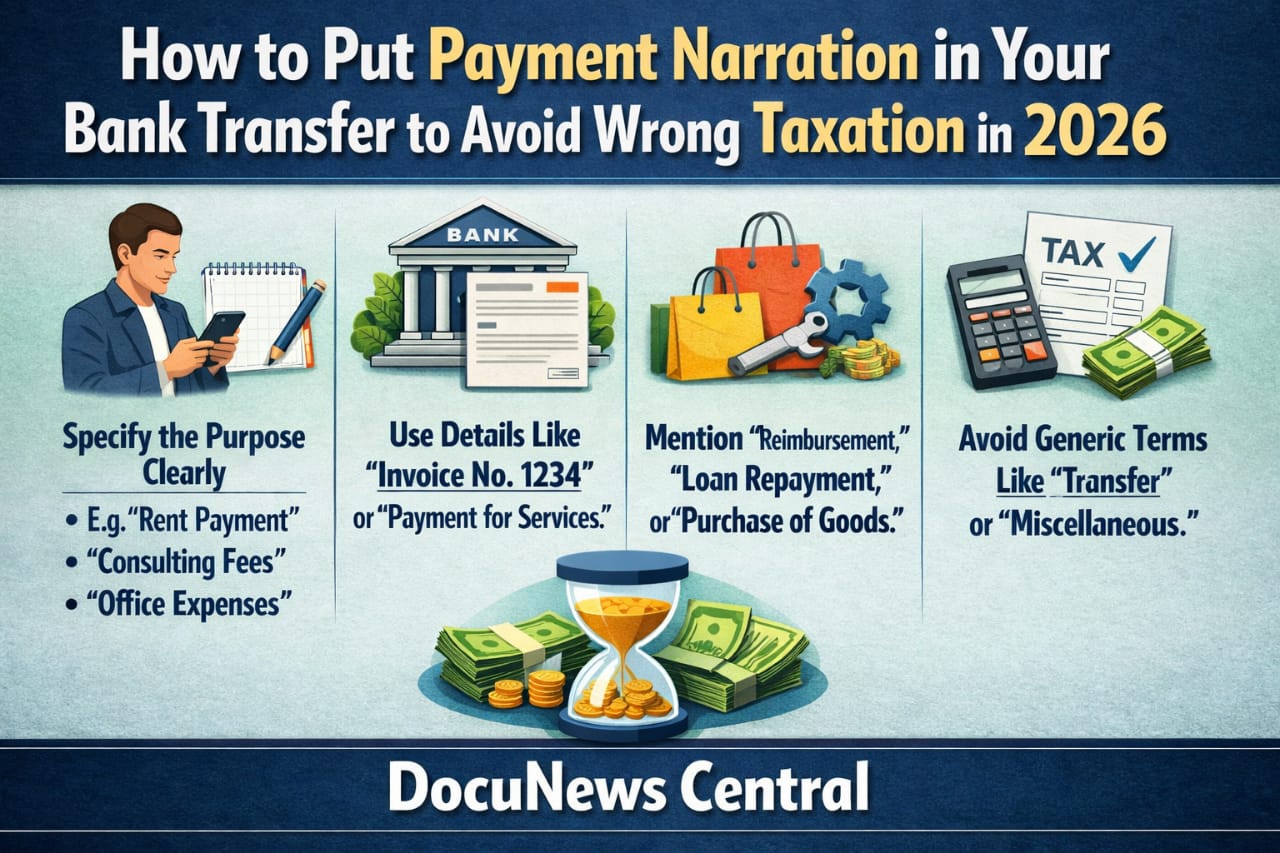

Digital banking has changed how money moves. Transfers now happen instantly, across banks, wallets, and platforms. However, while sending money feels easy, interpreting those transactions remains complex. Banks, auditors, and tax authorities do not see intent. Instead, they see numbers, frequency, and descriptions. So this headline is very important to everyone. Payment Narration in Your Bank Transfer to Avoid Taxation.

Because of that, payment narration has become one of the most overlooked yet powerful tools in personal and business finance. When narrations remain unclear, lawful transfers sometimes get mistaken for income. Consequently, unnecessary tax questions arise. In more serious situations, account reviews follow.

This guide explains how proper payment narration helps prevent wrongful taxation. It does not promote hiding income. Instead, it teaches clarity, accuracy, and compliance. Each section expands common transaction scenarios and explains how correct descriptions protect you during reviews. Read also Pound to Naira Update: FG’s ₦92.9trn Plan Against Hardship

Why Payment Narration Has Become Financially Important

Every bank transaction creates a permanent digital trail. Banks monitor inflows to detect fraud, money laundering, and tax inconsistencies. Meanwhile, tax authorities rely on transaction patterns to identify potential income streams.

When money enters an account without context, assumptions fill the gap. Unfortunately, assumptions often lean toward income classification. Therefore, narration acts as the first explanation layer.

Clear narration helps by:

- Explaining the purpose of funds

- Separating income from non-income

- Reducing unnecessary follow-up

- Supporting proper record keeping

As transaction volumes increase, clarity becomes protection.

International financial transparency principles, such as those issued by the Financial Action Task Force (FATF), emphasize traceability and explanation of funds. You can also read this information Top 10 Herbal Remedies in Nigeria | DocuNews Central

Taxable Income Versus Non-Income Transfers Explained

To understand why narration matters, the difference between income and non-income must be clear.

Taxable income usually includes salaries, wages, business revenue, professional fees, commissions, rents, and investment returns.

Non-income transfers include gifts, refunds, reimbursements, loans, personal savings movements, and capital contributions.

Problems arise when non-income transfers resemble earnings. Without explanation, repeated inflows may appear commercial. Proper narration prevents that misunderstanding.

You may also explore this related guide: Understanding Taxable vs Non-Taxable Income in Nigeria.

1. Family Support and Gifts: Using the Right Description

Family members support each other daily. Parents assist children. Siblings help siblings. Relatives contribute during ceremonies, emergencies, or personal transitions. These transfers do not represent income.

Correct narration: Gift / Family support

This wording immediately clarifies intent. Gifts involve no service exchange. Family support creates no profit. Therefore, banks and reviewers interpret the inflow correctly.

However, problems occur when vague terms appear repeatedly. Words like “payment” or “transfer” provide no context. As a result, they invite questions.

Best practices:

- Use relationship-appropriate descriptions

- Avoid business-sounding language

- Keep frequency reasonable

- Ensure sender identity aligns with narration

For regulatory clarity, consult guidance from the Federal Inland Revenue Service (FIRS) on income classification.

2. Refunds and Reimbursements: Receiving Back Your Own Money

Refunds and reimbursements represent returned funds. They do not create new income. Still, without explanation, refunded amounts may resemble fresh earnings.

Correct narration: Refund / Reimbursement

This description signals reversal rather than reward. It helps reviewers trace prior expenses and confirm balance.

Common scenarios include:

- Friend repaying borrowed funds

- Shared bills being settled

- Cancelled purchases refunded

- Unused event contributions returned

Mistakes happen when refunds mix with unrelated transfers or when casual words replace clear explanations. Always keep descriptions precise.

Related reading: How to Track Personal Expenses for Financial Transparency.

3. Personal Transfers and Savings: Moving Your Own Money

Moving money between accounts does not change ownership. However, banks still record each inflow independently. Without narration, internal transfers may appear external.

Correct narration: Personal transfer / Savings movement

This description confirms same ownership and eliminates third-party assumptions.

These narrations matter when transferring funds between:

- Salary and savings accounts

- Bank accounts and wallets

- Investment platforms

- Emergency funds

Consistent account naming further strengthens clarity during reviews.

4. Loans Received: Separating Borrowing From Income

Loans increase cash temporarily, not wealth. Repayment follows. However, undocumented loan inflows may appear suspicious.

Correct narration: Loan received

This wording establishes borrowing intent and signals future repayment.

Additional protection includes:

- Keeping written loan agreements

- Recording repayment narrations clearly

- Avoiding loan and business income mixing

When repaying, use descriptions such as Loan repayment for consistency.

Helpful guide: How to Document Personal Loans Properly.

5. Capital Contribution: Funding Your Business Correctly

Business owners often inject personal funds into operations. That money supports growth but does not represent sales.

Correct narration: Capital contribution

This description separates owner funding from customer payments and supports proper accounting treatment.

Entrepreneurs, freelancers, and sole proprietors benefit greatly from this clarity. Without it, capital inflows may inflate revenue figures incorrectly.

Recognized accounting standards classify such funds as owner equity rather than income.

How Proper Narration Helps During Bank Reviews and Audits

Reviews rely on patterns, consistency, and explanation. When narration aligns with reality, reviews move faster. When descriptions confuse intent, scrutiny increases.

Clear narration:

- Reduces follow-up questions

- Supports transaction tracing

- Builds credibility

Banks prefer clarity. Tax authorities value documentation.

Common Narration Mistakes That Trigger Questions

Despite good intentions, many people still make avoidable mistakes.

- Leaving narration blank

- Using generic words repeatedly

- Mixing transaction purposes

- Allowing senders to guess descriptions

A simple pause before confirming a transfer often prevents these errors.

What Proper Narration Does Not Do

Honesty matters. Proper narration does not remove legitimate tax obligations. It does not override actual income. It does not replace filing duties.

Instead, it prevents misclassification.

Actual earnings remain taxable. Clear narration only ensures the correct category applies.

See also: When You Must Still Pay Tax Despite Clear Narration.

Practical Checklist for Everyday Transfers

- Does the description match reality?

- Does the amount align with purpose?

- Is the frequency reasonable?

- Does the sender identity fit the narration?

This habit takes seconds but saves months of stress.

Final Thoughts: Clarity Is Financial Protection

Financial clarity protects more than money. It protects time, reputation, and peace of mind. Proper payment narration does not manipulate systems. Instead, it communicates truth clearly.

In today’s monitored financial environment, silence creates suspicion. Clarity builds trust. By describing transactions accurately, you reduce misunderstandings and remain compliant with confidence.

Education, transparency, and consistency remain the smartest financial tools available. Subscribe for more information here at wew.docunewscentral.com/#