Here are today’s exchange rate. Dollar to Naira Black Market Rate Today 11/02/2026. For all those who wants to change Dollar to Naira or Naira to Dollar. Here is what you need. On this day, 11th February 2026, the U.S. dollar trades in the unofficial parallel market at approximately ₦1,425 to ₦1,440 per $1. This rate reflects real supply and demand outside official channels, and it remains a key indicator for anyone involved in forex transactions or import/export businesses. (vanguardngr.com)

In Nigeria today, the parallel market continues to serve as a barometer for currency liquidity. These figures largely apply to major commercial hubs such as Lagos, Abuja, and Kano. Understanding this rate helps businesses, traders, and individuals to make informed decisions regarding imports, exports, remittances, and day-to-day transactions.

Nigeria Forex Landscape in Context

As of February 11, 2026, the Nigerian Naira shows some stability despite ongoing economic pressures. Recent reforms in foreign exchange policies have influenced how traders and the Central Bank interact with currency flows. Increased interventions by the Central Bank of Nigeria (CBN) is aimed to improve liquidity in both official and parallel markets. (reuters.com)

According to DocuNews Central, These efforts affect rates significantly. Traders and businesses monitor both official and black market rates, which sometimes diverge due to demand pressures and speculative activities. The black market remains crucial for people requiring immediate access to physical dollars, especially for imports, travel, or urgent transactions.

Understanding the Black Market Dollar Rate

The black market, also known as the parallel market, refers to unofficial currency trading outside regulated banking windows. Below are the Key points about the black market rate they include:

- It is determined by supply and demand rather than official CBN guidelines.

- Bureau de Change (BDC) operators, retail dealers, and money traders largely influence this rate.

- The CBN does not officially endorse these rates, but they remain widely used for cash transactions.

Currently, the black market rate hovers between ₦1,425 and ₦1,440 per $1. It remains slightly higher than official rates, highlighting ongoing demand for dollars in the parallel market. You can compare it here at (vanguardngr.com)

Why Black Market Rates Fluctuate

The black market rate does not remain static. Several factors cause fluctuations the following are the factors that caused fluctuations:

1. Supply and Demand Imbalance

When the supply of dollars increases through remittances or export revenue, the naira strengthens. Conversely, high demand for dollars pushes the rate higher, causing the black market to react swiftly.

2. Central Bank Interventions

The CBN regularly intervenes by selling dollars to licensed BDCs. These efforts increase liquidity, narrowing the gap between official and parallel market rates. (reuters.com)

3. Investor Sentiment

Foreign and local investors respond to Nigeria’s economic outlook. Positive sentiment often stabilizes the naira, while negative sentiment can trigger parallel market spikes.

4. Speculation

According to in-depth analysis made by DocuNews Central Speculation causes fluctuations. Traders sometimes anticipate shortages or surpluses, adjusting their buy/sell quotes. These speculative moves can lead to sudden fluctuations in rates within a single trading day.

Today’s Black Market Rate Breakdown

Here is a detailed look at the current parallel market rate:

- Typical Rate: ₦1,425 → ₦1,440 per $1

- Range Drivers: Supply and demand pressures in Lagos, Abuja, and Kano

- Trend: Slight softening compared to previous weeks due to improved liquidity

Official CBN rates remain lower and may not reflect immediate cash availability. For accurate figures on official rates, visit the Central Bank of Nigeria. Third-party aggregators such as Monierate also provide current estimates, where USD/NGN values hover around ₦1,437.25. ([monierate.com](https://monierate.com/?utm_source=chatgpt.com))

Official vs Parallel Market Rates

Understanding the distinction between official and black market rates is crucial:

| Market Window | Typical Use | Approx. Rate Today |

|---|---|---|

| Official (CBN/Bank) | Formal transfers, corporate FX | Lower than parallel |

| Parallel/Black Market | Immediate cash trades | ₦1,425 – ₦1,440 per $1 |

Official rates are influenced by CBN policy, while the parallel market reacts instantly to real cash flows and market sentiment.

Impact on the Economy and Daily Life

Businesses and Trade

SMEs rely heavily on black market rates to access dollars for imports or payments. Volatile rates, however, increase the cost of goods and services, affecting overall business planning and pricing strategies.

Remittances

Nigerians depending on family remittances benefit when parallel rates are higher. Informal channels often provide better conversion than banks for immediate cash needs.

Inflation and Purchasing Power

A large gap between official and parallel markets drives up costs for imported goods. This contributes to inflation, reducing the purchasing power of everyday Nigerians.

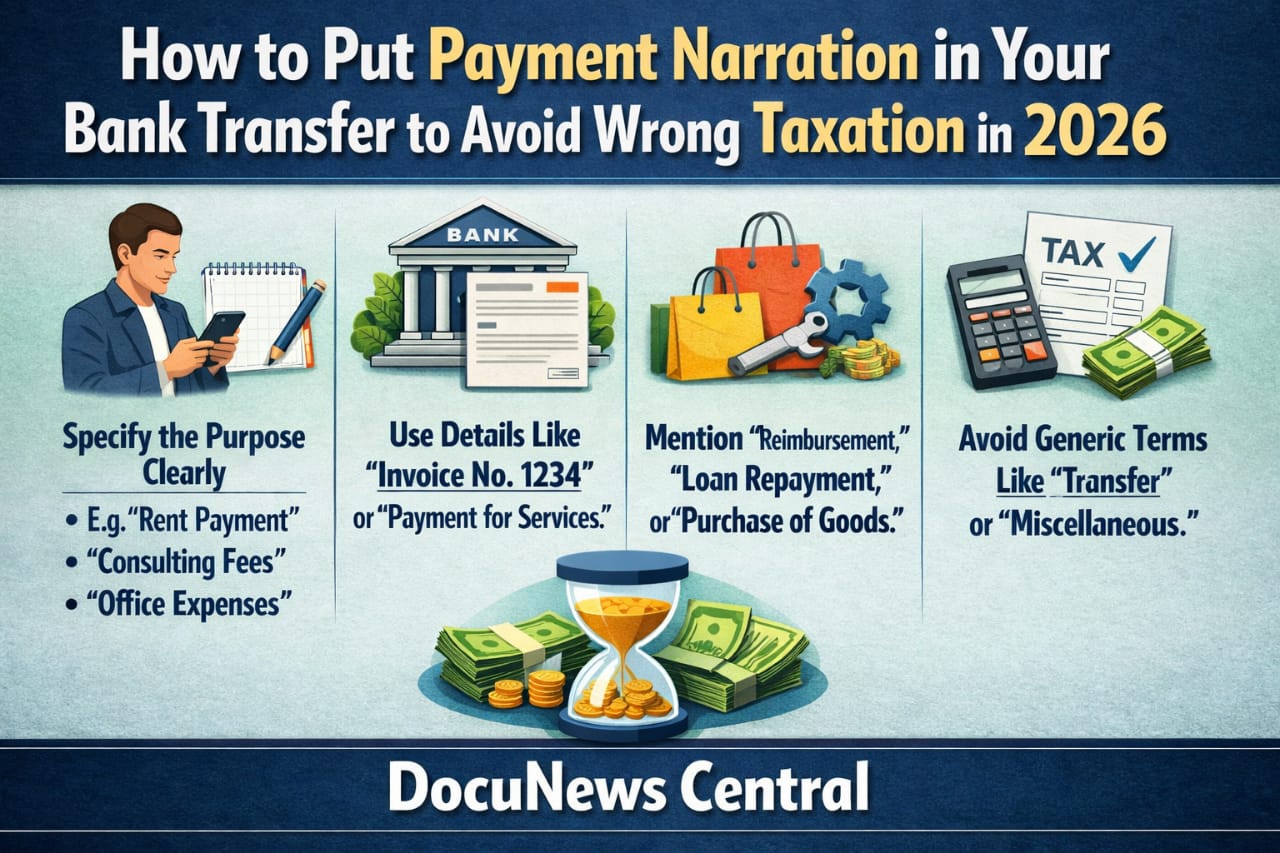

Practical Tips for Navigating the Forex Market

- Use licensed BDC operators for security and reliable rates.

- Compare quotes across multiple dealers to ensure fairness.

- Avoid roadside FX traders without verified credibility.

- Consider digital platforms offering transparent rates.

For forex analysis and historical trends, consult platforms such as Investing.com.

Analysts’ Insights

Forex analysts note that recent policy reforms aim to enhance liquidity and stabilize the naira. Weekly dollar allocations to licensed BDCs help reduce the gap between official and black market rates. (reuters.com)

Long-term economic reforms targeting inflation, foreign reserves, and investor confidence are expected to stabilize exchange rates further, reducing the volatility currently observed in parallel markets.

Frequently Asked Questions (FAQ)

1. What is the black market exchange rate?

It is the unofficial value of the dollar to naira, set by traders outside regulated banking windows, reflecting real-time supply and demand.

2. Why does it differ from official rates?

Official rates are regulated by banks and the CBN. Black market rates respond instantly to liquidity pressures, demand, and speculative behavior.

3. How often does it change?

Rates can fluctuate daily or even hourly depending on market dynamics.

4. Should I use black market rates?

Only when necessary and through licensed operators. Safety and transparency must be prioritized.

Conclusion

On 11th February 2026, the dollar to naira black market rate in Nigeria stands at approximately ₦1,425 – ₦1,440 per $1. It reflects a dynamic interplay of demand, supply, policy, and investor sentiment. (vanguardngr.com)

For ongoing updates, follow trusted currency portals and always transact through licensed dealers. At DocuNews Central, we provide in-depth insights into Nigeria’s financial and economic developments. Additional updates can be sourced from the Central Bank of Nigeria and Reuters Africa.

Useful Resources

- Central Bank of Nigeria – Official Rates and Policies

- Monierate – Current Forex Snapshots

- XE Currency Converter – USD/NGN

- Investing.com – USD/NGN Charts and Analysis

- Reuters Africa – Economic Reporting