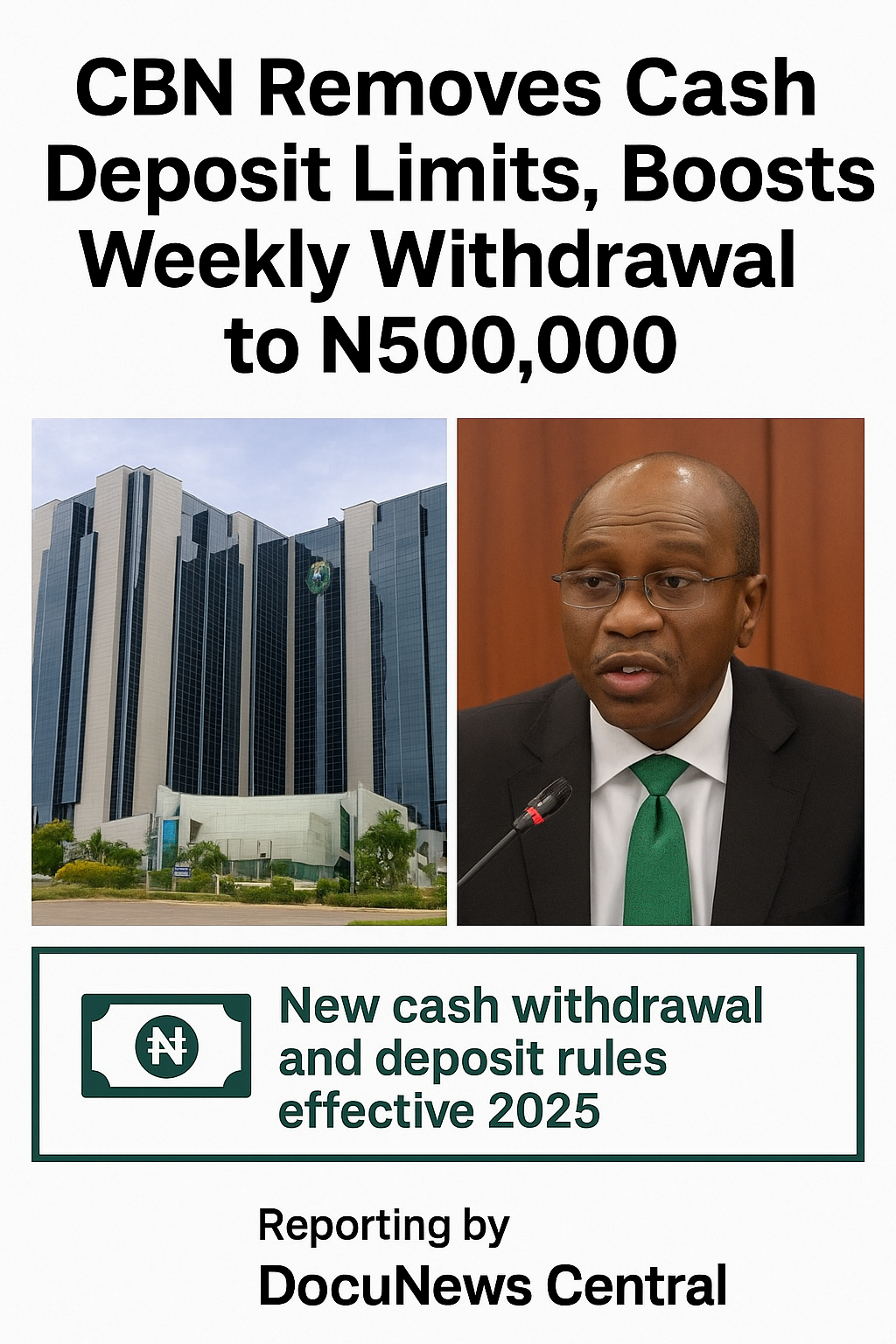

CBN Removes Cash Deposit Limits, Boosts Weekly Withdrawal to N500,000

In a major shift, the Central Bank of Nigeria (CBN) today abolished restrictions on cash deposits. Simultaneously, it raised the weekly cash withdrawal limit for individuals to ₦500,000 across all channels. The move marks a sharp reversal of earlier policy, and aims to ease some of the pressure Nigerians faced under strict limits. At the same time, it reflects the bank’s recognition of the country’s cash‑heavy financial reality.

What Exactly Changed?

Previously, the CBN had capped cumulative cash withdrawals across all channels (ATM, over‑the‑counter, POS, third‑party cheque encashment) for individuals at ₦100,000 per week. 1

Now, the new circular titled “Revised Cash‑Related Policies,” signed by the bank’s Financial Policy & Regulation Department, removes any limit on cash deposits altogether. 2

Moreover, starting January 1, 2026, individual customers may withdraw up to ₦500,000 weekly from all available channels. For corporate organisations, the cumulative weekly withdrawal limit across all channels is set at ₦5,000,000. 3

The circular also clarified that for withdrawals beyond those thresholds, customers may face “excess withdrawal” charges — 3 % for individuals and 5 % for corporates. 4

Additionally, the monthly special authorisation that once allowed individuals to withdraw up to ₦5,000,000 and corporates ₦10,000,000 in exceptional cases has been abolished under the new regulation. 5

For context: prior to the December 2022 revision, the limits were much lower. The original directive issued in 2012 under the Cash‑less Nigeria initiative capped daily free withdrawals for individuals at ₦500,000 and for corporates at ₦3,000,000 — but only under certain channels and conditions. 7

Why the Change? CBN’s Explanation

According to the CBN, the adjustments follow widespread feedback from stakeholders across the country. The bank acknowledged that the previous limits were too restrictive for many Nigerians, especially for those living in rural areas or working in informal sectors where cash remains dominant. 8

Moreover, the CBN emphasised that the cash‑handling environment has evolved. Over time, banks and financial institutions under its regulation have improved their systems, and the central bank deemed it necessary to “streamline and update” its provisions to reflect present‑day realities. 9

Also, the bank pointed out that the cost of cash‑management — including currency distribution, ATM loading, and security — has risen significantly. By adjusting these policies, CBN aims to moderate these costs without undermining access to cash. 10

What This Means for Everyday Nigerians

Greater flexibility for bank customers. Now, individuals and businesses can deposit as much cash as needed — a relief especially for those who occasionally receive large amounts (for sales, remittances, wages, etc.). The removal of deposit caps ends a barrier that many found unrealistic. Many deposit‑dependent households and small traders can breathe easier now.

Smoother withdrawals (up to the limit). The raised weekly withdrawal ceiling means individuals who previously struggled with weekly ₦100,000 caps can access more cash for daily expenses. For households paying rent or school fees, or for small traders needing stock, ₦500,000 weekly is a more workable buffer.

Cautious large‑value cash withdrawals. Even with higher limits, the CBN retains oversight. Withdrawals beyond the threshold may attract a fee. That discourages misuse while protecting legitimate customers. In effect, responsible cash users benefit; those seeking to abuse the system face deterrents.

Support for people in cash‑heavy regions. In many rural communities and informal markets — including parts of Rivers State — electronic banking or mobile payment infrastructure remains weak or unreliable. For such Nigerians, cash remains the backbone. This policy change acknowledges that reality and offers an inclusive adjustment. For that reason alone, many could view this as a pragmatic and empathetic regulation.

Voices from the Ground — What Customers Think

To understand how this affects ordinary Nigerians, we spoke to several bank customers and business owners. Some asked not to use their real names for privacy.

“I sometimes get payments from customers in cash, especially on busy market days,” said a small‑scale trader in Port Harcourt. “Before, I often deposited more than ₦500,000 at once and got scared the bank might reject it. Now I can deposit freely and manage my sales without stress.”

She added: “With ₦500,000 weekly withdrawal, I can take out enough to restock goods, pay labour, and still have change for customers. It makes business easier.”

“We run a small car‑parts shop,” said another customer. “Often, we pay wholesalers in cash. The old ₦100,000 weekly limit made that almost impossible. With the new rule, we stand a chance to thrive.”

Meanwhile, a civil‑servant in Abuja expressed cautious optimism: “I still prefer doing my salary transactions digitally. But sometimes you need cash — rent, medical bills, transport. Having ₦500,000 weekly makes it easier. But banks should not start charging abuses.”

On social media and in banking‑community chats, opinions remain mixed. Some customers worry that banks may still impose hidden charges or find technical loopholes. Others fear that sudden heavy withdrawals might trigger cash‑shortages at ATMs or bank branches. A few argue that the policy removes too much restriction — possibly inviting misuse. Yet many more celebrate the flexibility and call the move long overdue.

What Remains the Same — and What to Watch Out For

Even though deposit limits are gone and withdrawal thresholds raised, several rules remain in force:

- Banks must still collect standard identity information for large withdrawals — valid ID, Bank Verification Number (BVN), Tax Identification Number (TIN) where required, and possibly written approvals for very high amounts. 11

- Over‑the‑counter encashment of third‑party cheques above fixed thresholds (e.g. ₦100,000) remains restricted. These rules continue to apply. 12

- Withdrawals above the weekly limit may attract fees. Customers planning large‑value withdrawals should expect those charges. 13

- Even though deposit limits are lifted, banks may have internal procedures — so depositors should verify that their bank is aware of the new circular before making very large deposits. Otherwise, some banks may lag in implementation.

Hence, while the policy loosens restrictions, effective compliance at the bank‑level remains critical for real benefits.

How This Fits Into Nigeria’s Broader Cashless Agenda

The CBN did not abandon its long‑term objective of a less cash‑dependent economy. Rather, this new policy appears to be a recalibration — more flexible, more realistic, but still aligned with the broader direction. Indeed, the “Cash‑less Nigeria” policy began in 2012. Initially, it imposed cumulative limits on cash withdrawals and charged cash handling fees above thresholds. 14

Over time, the policy aimed to encourage electronic payments, reduce the volume of physical cash, minimize cash‑related crimes, and lower the cost of cash handling for banks and the central bank. 15

In fact, as recently as 2024, the CBN extended suspension of processing fees for large cash deposits — a sign it understood that depositors were struggling under earlier restrictions. 16

Therefore, today’s reversal may reflect a more nuanced understanding: cash remains essential in many parts of Nigeria, especially outside major cosmopolitan cities. At the same time, the bank can continue to promote digital payments — but without inflicting undue hardship. That middle path may finally balance ideals with ground realities.

Possible Risks & Challenges Ahead

Despite the legitimate benefits, this policy change may carry some risks if not managed carefully:

- Bank compliance lag: Some banks may delay updating their internal systems and procedures. Until all banks fully apply the new circular, some customers may continue to face old restrictions or inconsistent practices.

- Fraud and money‑laundering risks: Removing deposit limits may create vulnerabilities. Without robust customer‑due‑diligence and transaction monitoring, the system could be exposed to illicit flows. The CBN may need to work closely with banks to strengthen oversight.

- Uneven access to digital alternatives: While the CBN encourages digital channels, not everyone in Nigeria — especially in rural areas or less developed states — has reliable internet, smartphones, or familiarity with banking apps. For those people, cash remains indispensable. The policy must remain inclusive and flexible.

- Cash shortages or ATM liquidity pressure: If many customers withdraw near the ₦500,000 weekly limit at once — for instance at month‑end, harvest time, or festivals — banks may struggle to keep enough physical naira in ATMs or branches. This could create intermittent cash scarcity, especially in regions far from major banking hubs.

- Potential hidden bank charges or administrative delays: As banks adjust, some may attempt to recoup costs via new charges or delays. Customers should remain vigilant and demand transparency.

What Analysts and Observers Say

Some financial analysts view the move as pragmatic. One observer told DocuNews Central: “This isn’t a retreat — it’s a recalibration.” The goal is to reconcile the long‑term cashless vision with Nigeria’s current economic realities: a large informal sector, cash‑heavy transactions, unreliable digital infrastructure in many regions, and widespread poverty. In this context, pushing people completely out of cash might do more harm than good.

Others suggest the move simply responds to political and social pressure. They note that the earlier ₦100,000 weekly withdrawal cap proved unrealistic — especially for traders, artisans, and wage earners paid in cash. By removing deposit limits and relaxing withdrawals, the CBN likely hopes to reduce public discontent while still retaining oversight tools (fees, documentation requirements, withdrawal caps for excess amounts). In effect, they argue, the central bank is trying to regain public trust without abandoning its regulatory mandate. Documented history supports this view. For example, periodic suspensions of deposit‑processing fees for large deposits over the years show the bank sometimes backtracks when policies prove too strict. 17

Others remain skeptical. Some believe the relaxation could fuel cash hoarding or illegal cash flows — particularly in areas with weak enforcement. These observers warn the CBN must strengthen Anti‑Money Laundering (AML) measures, customer verification, and reporting protocols to prevent misuse. For them, the success of the policy depends heavily on bank compliance and regulatory vigilance.

What You Should Do Right Now

If you live in Nigeria — whether in a major city or a smaller community like Rivers State — here are steps to take now that the policy has changed:

- Check with your bank immediately. Confirm that they have received and implemented the new CBN circular. Ask if deposit limits are truly lifted and verify the new weekly withdrawal threshold. Make sure they update their internal policies accordingly.

- Plan large transactions ahead. If you expect to deposit or withdraw significant amounts, coordinate with the bank ahead of time. For withdrawals above ₦500,000 in a week, be ready with valid ID, BVN, and other documentation — and possibly pay the excess withdrawal charge if applicable.

- Continue using digital banking where possible. For routine payments — bills, utilities, transfers — consider mobile banking apps, USSD, POS, or other electronic means. These remain encouraged by the CBN and can be more convenient, secure, and cheaper over time.

- Keep records of large deposits or withdrawals. If you deal in cash-heavy business, maintain documentation (receipts, ledgers, notes) especially for large or frequent transactions. That could help if banks request verification, or if regulatory scrutiny increases.

- Be alert for hidden fees or bank‑level discrepancies. As banks transition their systems, some may attempt to recoup costs via new fees or delays. Always ask for transparent charges and challenge any unexpected deductions. Consumer awareness matters more than ever.

Conclusion: A Balanced, Realistic Adjustment

The new policy by CBN — scrapping cash deposit limits and raising weekly withdrawal thresholds to ₦500,000 — marks a significant shift. On one hand, it addresses the genuine hardships many Nigerians endured under previous strict cash‑limit regimes. On the other, it reflects bank’s willingness to adapt to ground realities. The change offers relief to cash‑dependent individuals, small traders, and informal‑sector workers who have long struggled with restrictive banking rules.

However, the success of this shift depends heavily on effective implementation. Banks must update internal systems, enforce required documentation for large withdrawals, and avoid hidden charges. Regulatory bodies must remain vigilant to prevent misuse, money‑laundering, or illicit cash hoarding. At the same time, the push toward a more digital economy need not stop — but should proceed in a realistic, inclusive manner.

For now, this policy offers a pragmatic middle path: not a full leap to cashless, nor a complete surrender to cash — but a balanced, thoughtful recalibration. As this unfolds, platforms like DocuNews Central will continue to track developments, report transparently, and help Nigerians understand how these changes affect their daily lives.

Read also: Naira Redesign Policy and What It Means for Nigerians, Cashless Nigeria: 2025 Update, What It Means for Small Businesses

For the full CBN circular, see the official website: CBN Update 2023